A noncitizen who married an American residing abroad, and who meets the conventional standards for spousal or survivor benefits, could be eligible for these payments if he / she:

What must i do now? the fax experienced presently despatched properly yesterday together with the certification of formation which is with out stamp. Only my signature and my registered agent’s signature in that certificate.

We can't make it easier to establish whether or not somebody is surely an personnel or an unbiased contractor, even so, you could speak with your accountant, Together with examining the following info furnished by the IRS: worker vs impartial contractor.

Take note: On another page you’ll see a note about “FCC rules demand us to make use of a US geographical caller ID when sending faxes to toll-absolutely free numbers”.

You at the moment are leaving AARP.org and about to a web site that isn't operated by AARP. A unique privacy coverage and terms of provider will implement.

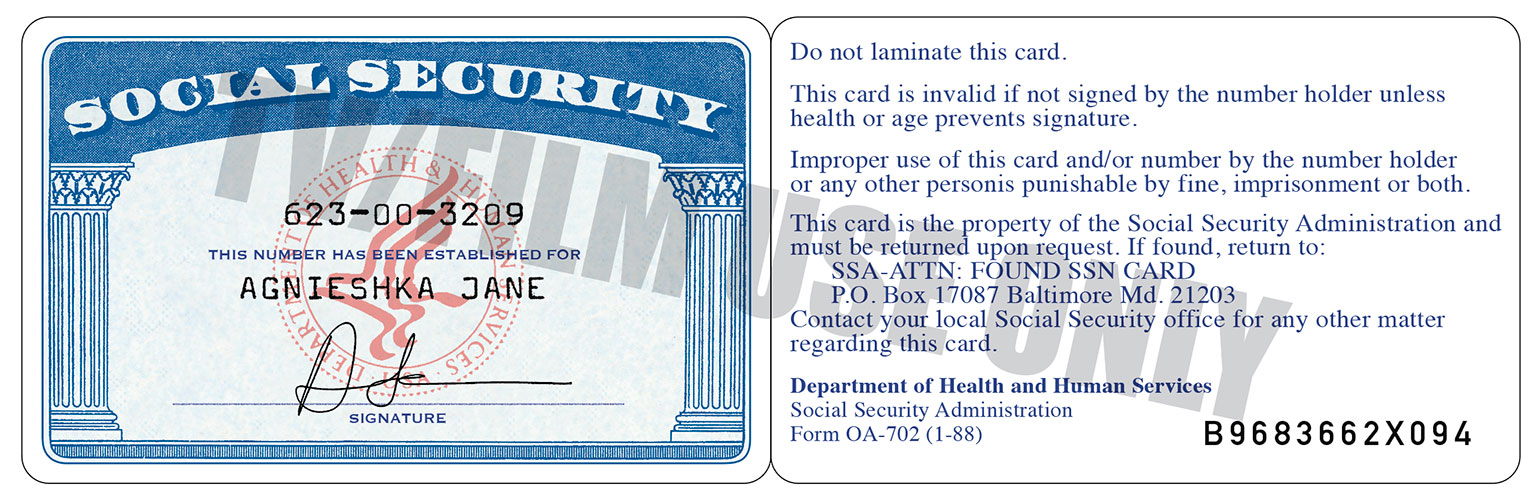

Non-U.S. citizens can get a Social Security number delivered They are really from the state lawfully. For those who have everlasting residency, you’ll be issued exactly the same variety of Social Security card that citizens get.

The article content of Corporation features just the organizer registered agent title and not my title. Will the IRS refuse my SS-four for that reason? should I have sent the functioning settlement Together with the fax?

For a number of people, it might take three months right before they obtain the EIN number. And it’s not merely non-US citizens waiting. Countless numbers and 1000s of Individuals also have to apply by fax (not all EINs might be applied for online by Us citizens). Men and women are waiting 2-3 months. In conclusion, it’s very best to Wait and see and just wait around until you listen to back with the IRS. They won't overlook you. They can Allow you are aware of if it’s accepted (most all of these are) or if you will discover issues. Once again, it’s just using lengthier than predicted.

I have used for an EIN by using fax as a non resident alien. I despatched it in early December 2020 but did not received any response nonetheless. Is the fact typical? Does one think that I should really I resend the SS-four into the IRS?

This information was incredibly valuable. You’re amazing. I ssn had been pondering if you can tutorial on how to get gross sales permit without the need of SSN/ITIN especially Texas Sales tax permit for an LLC if You're not in US.

Conversely, you'll be able to employ 1099 independent contractors, through which You aren't to blame for withholding and spending the above mentioned taxes.

The truth is, you can’t even make an application for an ITIN Unless of course you'll want to file a U.S. tax return. Meaning it’s full documents website unattainable to acquire an ITIN ahead of forming your LLC because the LLC would very first should exist and crank out income for the tax year, then when April fifteenth of the next 12 months arrives all over, you would submit your U.S. tax return in addition to your ITIN application.

Your files needs to be originals or Qualified full documents website copies within the agency that issued the first — such as, the county in which you been given your relationship license. Social Security will not accept photocopies and even notarized copies.

2) If I never decide for his or her virtual Office environment approach, would I get a scanned duplicate of your doc that's despatched by EIN to that registered tackle (and that is from North West as portion in their “Registered Agent” strategy, which is similar within the “Certification of Formation”).

Comments on “5 Tips about ssn You Can Use Today”